Smart Taxes: Roth IRA

Submitted by Younity Wealth Partners on May 9th, 2017Updated: April 9th, 2017 by Kara Downing, CFP®

Without fail as Tax Day approaches every year, the mind whirls while you check boxes and fill in numbers about everything you could have, should have, would have done to save more money on taxes. Could you have saved more? Invested better? Been smarter at charitable giving? Probably. It’s too late for some money-saving measures in the last minute lead up to the deadline for filing your taxes, but one you can take on simple measure to maximize your tax advantages (perhaps now, and certainly later)—set up a Roth IRA account.

Roth IRA 101

What’s so special about a Roth IRA? Compared to a traditional IRA, you can contribute at any age as long as your Modified Adjusted Gross Income (MAGI) is below a certain limit and you have taxable compensation. Unlike traditional IRAs, contributions are made on an after-tax basis, there are no mandatory distribution requirements, and withdrawals are tax-free.

Contribution Limits

Through the year (2017) your total contributions to all IRA accounts (traditional and Roth) combined cannot be more than $5,500 or $6,500 if you’re age 50 or older.

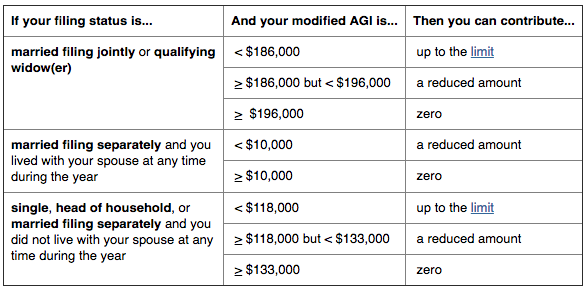

For a Roth IRA there’s a whole other table that delineates who can and cannot contribute. Let’s say you’re married and filing jointly. If your modified AGI is greater than or equal to $196,000 you can’t contribute anything. If you and your partner’s modified AGI is less than $196,000 but greater than $186,000 you can only contribute a reduced amount. Only those couples with a modified AGI less that $186,000 can contribute up to the limit.

Table for 2017, irs.gov

What about other retirement plans?

A Traditional IRA can offer tax benefits, but the window for those who qualify for the deduction is limited.

Depending on your IRA set-up you’ll either deduct the contribution from your taxes on the current tax year or do so after you turn 59 and a half. (Whatever you do, don’t pull the money back out until after you are age 59 and a half.)

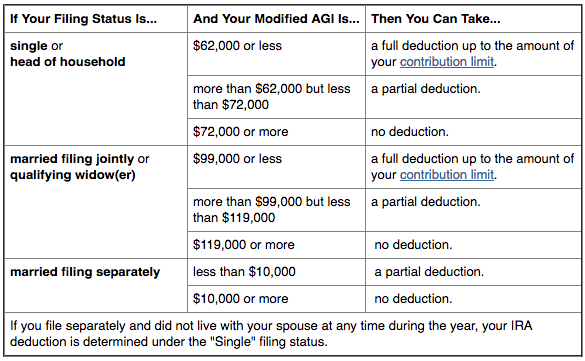

If you (or your spouse) is covered by a retirement plan at work, you’ll be able to take a full deduction up to the amount of your contribution limit if the modified AGI is $98,000 or less. AGI equaling more than $99,000 and less than $119,000 can take a partial deduction.

Table for 2017, irs.gov

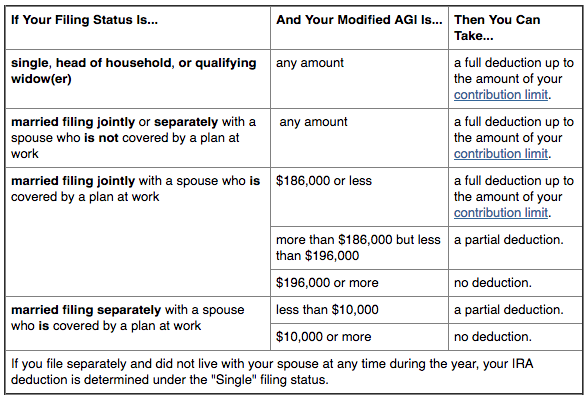

As you could guess the table figures look different if you’re not covered by a retirement plan at work. Then of course things get even more complicated if one spouse is covered by a work plan and the other isn’t.

Table for 2017, irs.gov

Luckily, you don’t have to pick just one IRA to contribute to. You could split your money between multiple different accounts.

Expert Advice

Because IRAs can be complicated, especially when it comes to how much you can contribute, who can deduct what, and when you can utilize the money it’s important to talk to a trusted financial advisor. They’ll best be able to point you in the right direction given your personal financial goals.